Benefits

CalPERS Retirement Overview

Secure, pension-based retirement plan for eligible CSU employees.

What is CalPERS?

CalPERS is a defined benefit pension plan that provides eligible CSU employees with

a lifetime monthly retirement income.

CalPERS is a defined benefit pension plan that provides eligible CSU employees with

a lifetime monthly retirement income.

Your benefit is calculated using a formula that considers your years of service, age

at retirement, and your highest salary. CalPERS benefits are coordinated with Social

Security and include additional options such as disability retirement and survivor

benefits.

Most eligible employees are automatically enrolled in CalPERS upon hire.

CalPERS Eligibility

You are generally eligible if you are:

- A full-time employee appointed for more than six months

- A part-time employee working at least half-time for more than one year

- A lecturer who has worked at least half-time for two consecutive semester—membership begins at the start of the third consecutive semester if the pattern continues

Not eligible for CalPERS? You may be enrolled in the PST Retirement Program. Learn About PST

More About Retirement Benefits

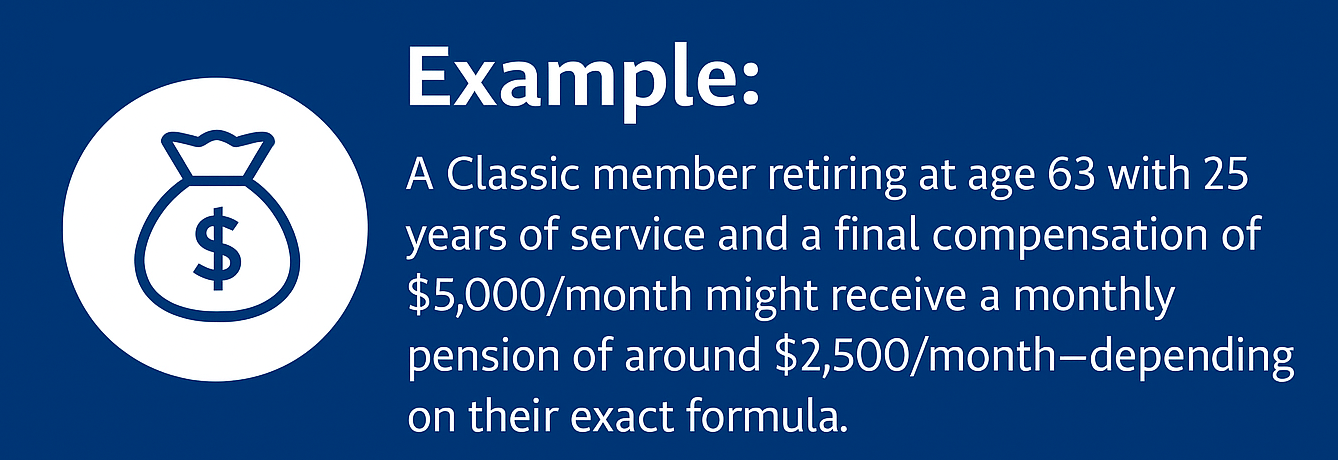

Your CalPERS pension is calculated using a formula that includes:

- Your years of CalPERS service credit

- Your age at retirement

- Your highest average monthly pay (also called “final compensation”)

These three factors are used in a set formula defined by your CalPERS membership tier (Classic or PEPRA).

You can view your estimated pension anytime through your myCalPERS account, or by scheduling a retirement planning appointment with CalPERS.

To be vested in CalPERS means you have earned the right to receive a retirement benefit—even if you leave your job before retiring.

You are considered vested once you have:

- At least 5 years of CalPERS service credit

- (Or 10 years if you're a member of certain other retirement systems and using reciprocity)

Once vested, you’re eligible to begin receiving a monthly CalPERS pension when you reach the minimum retirement age for your membership tier.

📌 You can check your vesting status by logging in to myCalPERS.

CalPERS Retirement: Vesting Requirement for Health/Dental Benefits

In order to qualify for health/dental in retirement, you must retire from a benefit

eligible position within 120 days of separation from the CSU AND meet either the five

year or ten year vesting requirement. (see chart below).

- Retirees pay the same health contribution as active CSU employees.

- Dental Retiree plan premium is paid by CalPERS.

- The vision benefit can be continued at the retiree's expense.

In addition, benefits are provided for disability, death, and to survivors or beneficiaries of eligible members. Exception to Ten Year Vesting Requirement: Disabled employees would receive the full state health contribution if they separate and retire with a disability retirement within 120 days from a benefits eligible appointment.

| Employee Group / Bargaining Unit | First hired by CSU And new CalPERS member on or after July 1, 2018 | First hired by CSU And new CalPERS member on or after July 1, 2017 | Hired by CSU And new CalPERS member prior to July 1, 2017 |

|---|---|---|---|

| R03 | 10 years | 10 years | 5 years |

| M98, M80, C99, E99 | 10 years | 5 years | 5 years |

| R01, R02, R04, R05, R06, R07, R09 | 10 years | 5 years | 5 years |

| R08 | 5 years | 5 years | 5 years |

Visit csuretirees.vspforme.com to learn more.

📘 Want a full overview of CSU retiree benefits?

Download the CSU Retiree Benefits Booklet (PDF)

The age you can retire and begin receiving CalPERS benefits depends on your membership tier—either Classic or PEPRA (Public Employees' Pension Reform Act).

Minimum Retirement Ages:

- Classic members: 50

- PEPRA members: 52

You must be vested (usually 5 years of service credit) to retire. The longer you wait to retire—and the older you are when you retire—the higher your monthly pension benefit will be.

📌 Your official membership tier is listed in your myCalPERS account.

CalPERS uses different retirement formulas based on when you first became a CalPERS member. This determines your membership tier and affects how your benefit is calculated.

Common CSU Formulas:

| Membership Tier | Formula | Minimum Age | Example Contribution Limit |

|---|---|---|---|

| Classic | 2% at 55 | 50 | $350,000 |

| Classic | 2% at 60 | 50 | $350,000 |

| PEPRA | 2% at 62 | 52 | $155,051 (2025, with Social Security) |

- Classic members typically entered CalPERS before January 1, 2013

- PEPRA members joined on or after January 1, 2013, or had a break in service and returned later

Each formula uses a percentage multiplier (like 2%) applied to your service credit and final compensation to calculate your pension.

📌 Your membership tier is assigned automatically and can be viewed in myCalPERS.

CalPERS uses different retirement formulas based on when you first became a CalPERS member. This determines your membership tier and affects how your benefit is calculated.

Common CSU Formulas:

| Membership Tier | Formula | Minimum Age | Example Contribution Limit |

|---|---|---|---|

| Classic | 3.0% at 50 | 50 | $350,000 |

| Classic | 2.5% at 55 | 50 | $350,000 |

| PEPRA | 2.5% at 57 | 50 | $186,096 |

- Classic members typically entered CalPERS before July 1, 2011

- PEPRA members joined on or after January 1, 2013, or had a break in service and returned later

Each formula uses a percentage multiplier (like 2%) applied to your service credit and final compensation to calculate your pension.

📌 Your membership tier is assigned automatically and can be viewed in myCalPERS.

If you’re unable to continue working due to a permanent disability, you may be eligible to retire under CalPERS disability retirement.

To qualify, you must:

- Be vested (typically with 5 years of CalPERS service credit)

- Have a medical condition that prevents you from performing your current job duties

- Submit medical documentation and go through a CalPERS approval process

Disability retirement is different from industrial disability retirement, which applies to certain public safety and job-specific injuries.

📌 Disability retirement must be approved by CalPERS and may include a different calculation method than standard service retirement.

Learn more and begin the process: Visit the CalPERS Disability Retirement Page

CalPERS provides survivor and death benefits to eligible beneficiaries when a member passes away—either before or after retirement.

The type and amount of the benefit depend on:

- Your employment status at the time of death

- Whether you were retired or still an active employee

- Your retirement option and beneficiary designations

Common benefits include:

- Lump-sum death benefits

- Continuing monthly income for a surviving spouse or registered domestic partner

- Refund of member contributions if no monthly benefit applies

To ensure your loved ones receive the correct benefits, keep your beneficiary designations up to date in your myCalPERS account.

📌 Contact CalPERS or the HR Benefits team if a family member passes away while employed or shortly after retirement.

You can estimate your future CalPERS retirement benefit using tools available in your myCalPERS account.

With the Retirement Estimate Calculator, you can:

- View personalized pension estimates based on your current data

- Compare different retirement dates

- See how age, service credit, and final compensation impact your benefit

- Explore various retirement options (e.g., beneficiary continuance)

To access the calculator:

- Visit myCalPERS

- Log in or register for an account

- Navigate to “Retirement Estimate Calculator” under the Retirement section

📌 We recommend running multiple estimates and reviewing them with the HR Benefits team as part of your retirement planning process.

Ready to Retire?

✅ Steps to Take:

- Notify your manager and HR Benefits 90 days before retirement date

- Review your retirement estimate in myCalPERS

- Schedule a counseling appointment with CalPERS

- Complete and submit your CalPERS retirement application

- Submit required CSU forms to the HR Benefits team

CalPERS recommends starting your retirement planning up to one year in advance, so you have time to review benefit estimates, explore options, and attend counseling sessions if needed.

📌 Use the contact cards below to reach your designated HR Benefits representative for retirement planning support.

CalPERS Compensation Limits for 2026

Classic Members

The compensation limit for classic members for the 2026 calendar year is $360,000. Employees with membership dates prior to July 1, 1996, are not impacted by these limits.

PEPRA Members

Employees who became CalPERS members on or after January 1, 2013, are subject to annual compensation limits when calculating retirement benefits. Compensation limit for PEPRA members for the 2026 calendar year:

- Social Security Participants: $159,733

- Non-Social Security Participant: $191,679

These limits apply to members in the 2% at 62 and 2.5% at 57 retirement formulas.

Once an employee reaches the applicable limit, both employee and employer CalPERS contributions stop for the remainder of the calendar year and resume the following January.

Impact on Final Compensation

For classic members, final compensation is the highest average annual compensation earnable for a 12- or 36-consecutive-month employment period, depending on your contract.

Classic members’ retirement allowances are subject to final compensation limits under IRC section 401(a)(17). The calculation of each 12-month period will be subject to the annual compensation limit in effect for the calendar year in which the 12-month period begins. If final compensation exceeds 12 months, each 12-month period is calculated based on the applicable annual compensation limit for that 12-month period.

For PEPRA members, final compensation is the average annual pensionable compensation for a 36-consecutive-month employment period.

PEPRA members’ retirement allowances are subject to pensionable compensation limits under Gov. Code section 7522.10. The pensionable compensation limit — used to calculate final compensation — is calculated based on the limit in effect for each calendar year and the number of days per year included in the final compensation period.

Questions

If you have questions, call the CalPERS Customer Contact Center at 888 CalPERS (or 888-225-7377).

Last Name A-L

Debra Penner

Benefits Analyst

dpenner@mail.fresnostate.edu

559.278.4657

Last Name M-Z

Sarah Confer

Benefits Manager

sarahconfer@mail.fresnostate.edu

559.278.8237